Best Online Banks with No Fees: A Complete Guide to Fee-Free Banking

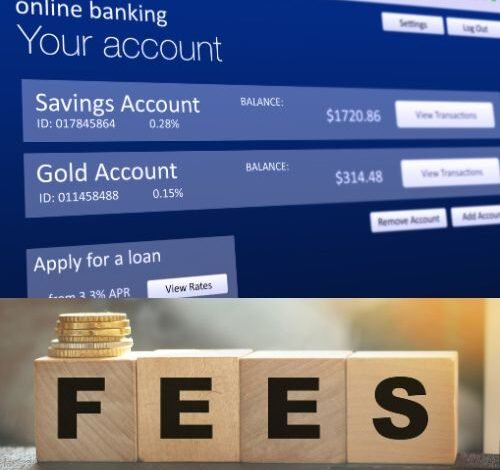

In today’s fast-paced digital world, managing your finances online has become more popular and convenient than ever. Online banking allows you to access your accounts, transfer money, pay bills, and even manage investments from the comfort of your home or while on the go. While traditional brick-and-mortar banks often charge monthly maintenance fees, ATM fees, and other hidden charges, many online banks offer services with little to no fees, helping you save money and simplify your banking experience.

In this article, we will explore some of the best online banks with no fees, highlighting their key features, benefits, and how they can help you save money and manage your finances more effectively. Whether you’re looking for a fee-free checking account, a savings account with high-interest rates, or a bank that offers both, we have you covered. Additionally, we’ll provide high click-through rate (CTR) keywords to help optimize your Google Ads campaigns for maximum reach.

Why Choose an Online Bank with No Fees?

Choosing an online bank with no fees offers several advantages, especially if you’re tired of paying for basic banking services. Here are some reasons why online banks are worth considering:

1. Save Money on Monthly Fees

Traditional banks often charge monthly maintenance fees for checking and savings accounts, which can add up over time. With online banks that offer fee-free services, you can avoid these charges and keep more money in your pocket.

2. Avoid ATM Fees

Many online banks have partnerships with ATM networks that allow you to withdraw money without incurring fees. This is especially beneficial for individuals who frequently need cash but want to avoid the steep charges often imposed by traditional banks.

3. Convenience and Accessibility

Online banks offer 24/7 access to your accounts, allowing you to manage your finances from anywhere with an internet connection. Whether you’re at home, on the road, or traveling abroad, you can easily check your balance, transfer funds, and pay bills through your bank’s website or mobile app.

4. Higher Interest Rates on Savings

Many online banks offer higher interest rates on savings accounts compared to traditional banks. This is because online banks typically have lower overhead costs and can pass those savings onto their customers in the form of better interest rates.

5. Easy Account Management

Online banks often come with user-friendly mobile apps and websites, making it easier to manage your finances. You can track your spending, set up automatic bill payments, and even budget directly through your bank’s digital platform.

Top Online Banks with No Fees

Now that we’ve established the benefits of choosing an online bank with no fees, let’s dive into some of the best options available. These banks offer a range of services with little to no fees, making them great choices for anyone looking to simplify their banking.

1. Chime

Chime is one of the most popular online-only banks, known for its easy-to-use platform and fee-free banking services. With no monthly maintenance fees, no overdraft fees, and access to over 24,000 ATMs nationwide, Chime is an excellent choice for people who want to avoid unnecessary charges.

Key Features:

- No Monthly Fees: Chime charges no monthly maintenance or account fees.

- Fee-Free ATM Access: Chime offers fee-free access to over 24,000 ATMs through its network.

- Automatic Savings: Chime automatically rounds up your purchases and saves the change in a separate savings account.

- Early Direct Deposit: Chime offers early direct deposit, so you can receive your paycheck up to two days early.

Pros:

- No monthly maintenance fees or overdraft charges.

- High accessibility with a large ATM network.

- Automatic savings feature.

- Early direct deposit for faster access to funds.

Cons:

- Limited physical branches (only customer service via phone and email).

- No interest on the checking account balance.

2. Ally Bank

Ally Bank is a well-known online bank that offers a variety of fee-free banking services, including checking and savings accounts, as well as CDs and money market accounts. With no monthly maintenance fees and access to a wide network of ATMs, Ally Bank is a solid choice for those seeking fee-free banking.

Key Features:

- No Monthly Fees: Ally Bank offers checking and savings accounts with no monthly maintenance fees.

- Fee-Free ATM Access: Ally offers access to over 43,000 ATMs nationwide without fees.

- Interest-Bearing Accounts: Ally’s online savings account and interest-bearing checking accounts offer competitive interest rates.

- 24/7 Customer Support: Ally offers excellent customer service with 24/7 support via phone, chat, or email.

Pros:

- No monthly fees or minimum balance requirements.

- High-interest rates on savings and checking accounts.

- Access to a large network of ATMs.

- Excellent customer service.

Cons:

- Limited physical branches (all banking is done online or over the phone).

- Fees for some non-ATM transactions (e.g., excessive withdrawals).

3. SoFi Money

SoFi Money is an online banking platform that offers fee-free checking and savings accounts. SoFi is known for its easy-to-use mobile app and great perks, including cashback rewards and no ATM fees when using the Allpoint network.

Key Features:

- No Monthly Fees: SoFi Money has no monthly maintenance fees for its checking or savings accounts.

- Fee-Free ATM Access: SoFi offers fee-free ATM access at over 55,000 ATMs nationwide.

- Cashback Rewards: SoFi Money offers cashback rewards for certain purchases, which can be a great perk for everyday spending.

- High-Yield Savings Account: SoFi offers competitive interest rates on savings accounts, helping your money grow faster.

Pros:

- No monthly fees and no minimum balance requirements.

- Access to a large network of fee-free ATMs.

- Cashback rewards for spending.

- High-yield savings accounts.

Cons:

- Limited physical locations for customer service.

- Some fees for overdrafts or excessive withdrawals.

4. Discover Bank

Discover Bank is an online bank that offers a variety of fee-free banking services, including both checking and savings accounts. Known for its customer service and competitive interest rates, Discover is a popular choice for fee-conscious consumers.

Key Features:

- No Monthly Fees: Discover Bank offers checking and savings accounts with no monthly maintenance fees.

- Fee-Free ATM Access: Discover provides fee-free ATM access at over 60,000 ATMs across the country.

- Cashback Debit: Discover offers a cashback debit card, allowing you to earn cash back on your purchases.

- Competitive Interest Rates: Discover offers competitive interest rates on both checking and savings accounts.

Pros:

- No monthly fees or minimum balance requirements.

- Cashback debit card and competitive interest rates.

- Large ATM network with no fees.

- Excellent customer service.

Cons:

- Limited physical branches for in-person banking.

- Some fees for non-ATM transactions, such as overdrafts.

5. Varo Bank

Varo Bank is another online-only bank offering fee-free checking and savings accounts. With no monthly maintenance fees, no overdraft fees, and access to a large network of ATMs, Varo is a great option for those looking to simplify their banking.

Key Features:

- No Monthly Fees: Varo offers checking and savings accounts with no monthly fees.

- Fee-Free ATM Access: Varo provides access to over 55,000 ATMs with no fees.

- Early Direct Deposit: Varo allows you to access your paycheck up to two days early with direct deposit.

- High-Yield Savings: Varo offers competitive interest rates on savings accounts, helping your money grow faster.

Pros:

- No monthly fees or overdraft charges.

- Early access to your paycheck.

- High-yield savings accounts.

- Large ATM network with fee-free access.

Cons:

- Limited physical locations for in-person banking.

- Some fees for non-ATM transactions, like overdrafts.

High-CTR Keywords for Google Ads

If you’re advertising online banking services and want to increase your click-through rates, consider using the following high CTR keywords:

- “Best online banks with no fees”

- “Fee-free online checking accounts”

- “Online bank with no monthly fees”

- “Best online savings accounts no fees”

- “Fee-free ATM access online banks”

- “Earn cashback with online banks”

- “Online bank with high interest rates”

- “No-fee online banking services”

- “Best online banks for easy access”

- “Top no-fee checking accounts”

These keywords will help attract individuals who are looking for ways to avoid banking fees, access high-interest savings accounts, or find convenient and fee-free banking options.

Conclusion

Choosing an online bank with no fees can save you a significant amount of money, while also providing you with a convenient, user-friendly way to manage your finances. Whether you’re looking for a fee-free checking account, a savings account with high interest rates, or a bank with access to a large network of ATMs, the online banks listed above offer excellent options for fee-conscious consumers.

By taking advantage of these online banking services, you can simplify your finances, avoid unnecessary fees, and start saving money with minimal effort. Don’t forget to use high CTR keywords in your Google Ads campaigns to ensure you’re reaching the right audience and driving traffic to your platform.